does colorado have a solar tax credit

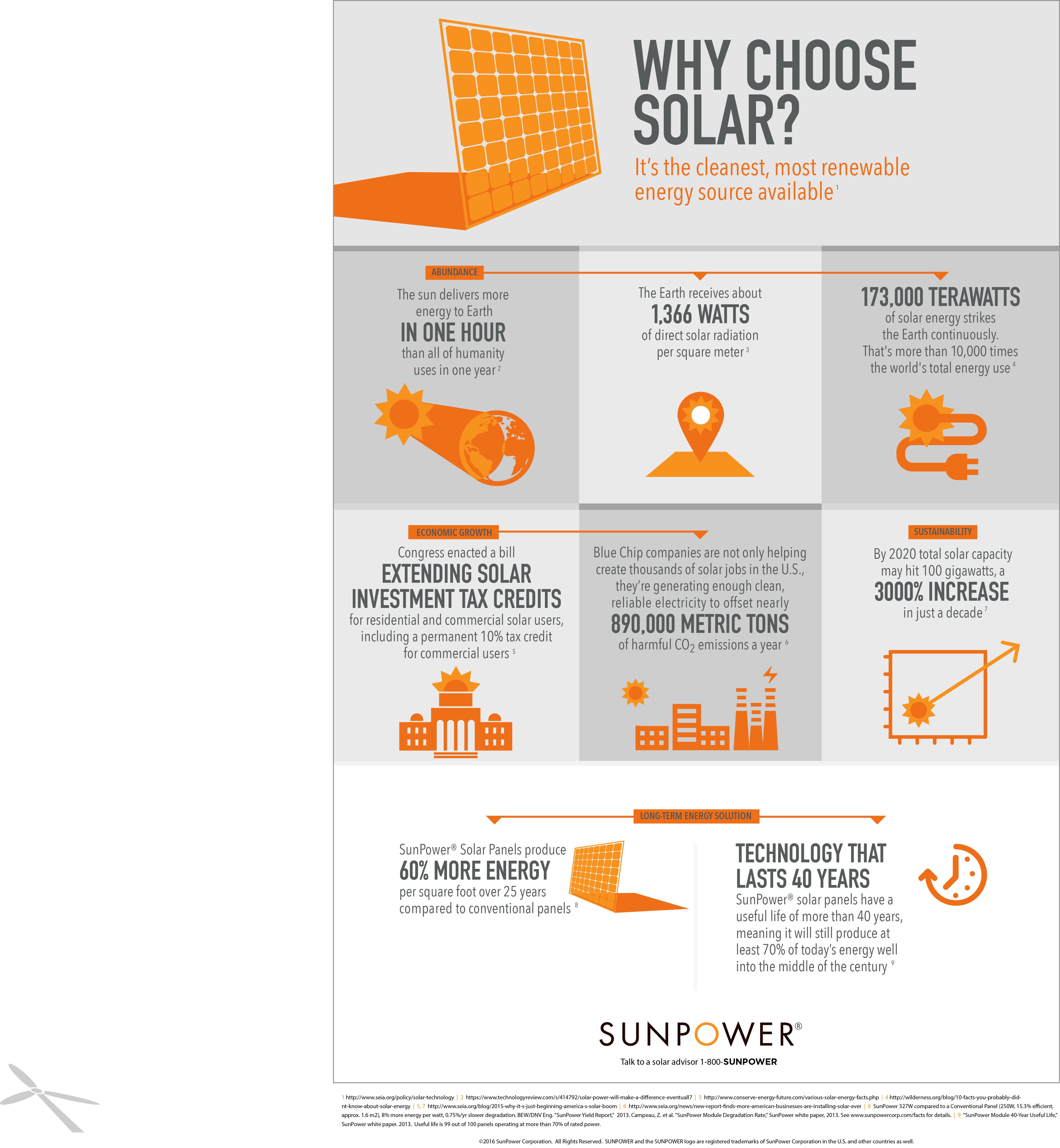

Does Colorado Have A Solar Tax Credit - Commercial solar pv systems are required to derive a minimum of 75 of their power from solar on a sliding scale to be eligible. Ad Step 1 - Enter ZipCode for the Best Colorado Solar Pricing Now.

Solar Power 4 Money Saving Tips For Diy Home Solar Power System Solar Power House Solar Energy System Solar Power System

30 for equipment placed in service between 2017 and 2019.

. Xcel Energy offers rewards for small medium and large solar installs. On top of these great Colorado rebates and exemptions you also qualify for the sizable tax credit from the Federal. For example if your solar PV system was installed before December 31 2022 cost 18000 and your utility gave you a one-time rebate of 1000 for installing the system your tax credit would be calculated as follows.

The IRS has permitted a taxpayer to claim a section 25D tax credit for purchase of a portion of a community solar project. Get Up To 4 Free Solar Quotes By Zip. Find Colorado Solar Prices By Zip.

Save time and file online. 5 Things to Know About Colorado Solar Incentives. Summary of solar rebates available to Colorado residents.

You may use the Departments free e-file service Revenue Online to file your state income tax. Roaring Fork Valley and Crystal River Valley. Rebates of anywhere from 400 to 2500 depending on where you live are available for solar installations on homes in Pitkin and Eagle counties Eagle Valley the Town of Vail and Summit County.

Please consult your tax preparer. Some Colorado utility companies may offer cash rebates for residential solar installations. After you file you have the option of setting up a Login ID and Password to view your income tax account in Revenue Online.

In Colorado the carve-out was 3 by 2020. A carve-out is that portion of a states renewable energy that must come specifically from solar. Solar industry has grown by more than 10000 with an average annual growth of 50 over.

In the years since the US. This federal tax credit is available to colorado homeowners and provides a 26 tax credit of the entire solar system cost including a battery system. Net Metering and Power Purchasing Agreements.

Colorado easily has some of the strongest support in the nation for renewable energy. Colorado State Property Tax Exemption for Solar Power Systems. State tax expenditures include individual and corporate income tax credits deductions and exemptions and sales and use tax exemptions.

For example EnergySmart Colorado offers 400 3000 rebates depending on where you live. Currently Colorado does not have a Feed-In Tariff system in place. 22 for equipment placed in service in 2023.

This perk is commonly known as the ITC short for Investment Tax Credit. There may still be other local rebates from your city county or utility. This federal tax credit is available to colorado homeowners and provides a 26 tax credit of the entire solar.

12720 Approximate system cost in Colorado after the 26 ITC in 2021. Tax savings will decrease as the principal is paid down. Your equipment AND installation costs for an unlimited amount.

See all our Solar Incentives by. The residential ITC drops to 22 in 2023 and ends in 2024. Does Colorado Have A Solar Tax Credit - Not only does the state get more than 300 days of sunshine per year.

If you install your photovoltaic system in 2020 the federal tax credit is 26 of the cost of your solar panel. Colorado Solar Carve-Out. 26 for equipment placed in service between 2020 and 2022.

Please note that this will decrease as more residential solar comes online so the longer you wait the more you will pay out of pocket. Colorado is renowned for its 300 sunny days per. 026 18000 - 1000 4420.

Buy and install new solar panels in Colorado in 2021 with or without battery storage and qualify for the 26 federal solar tax credit. If you have a solar panel system that generates 100 of that this program will earn you 339 per month or 4068. Dont Forget the Federal Tax Credit Colorado.

Colorados Solar Friendly Communities is an offshoot of the national Sunshot Initiative that has resulted in several municipalities and county governments developing streamlined application and approval processes. Currently this will equate to an extra 055watt which makes the total upfront solar rebate 255watt. The income tax credit is.

The federal government enacted the solar Investment Tax Credit ITC in 2006. Get Colorado Solar Panel Quotes. This memorandum provides an overview of the financial incentives for solar power offered by utilities in Colorado as well as other incentives including net metering programs.

Compare Colorado Solar Prices - Dont Overpay Get Expert Installation Now. While colorado is a leader in solar energy the state itself does not offer any tax credit on solar energy. 6 Approximate average-sized 5-kilowatt kW system cost in Colorado.

You do not need to login to Revenue Online to File a Return. Federal solar investment tax credit. Federal Tax Credit which will allow you to recoup 26 of.

30 off system price through 2019. One reason for this might be that there are many rebates and grants elsewhere through local governments and utility companies. For example a commercial.

All of Colorado can take advantage of the 26. While Colorado is a leader in solar energy the state itself does not offer any tax credit on solar energy. Heres a quick example of the difference in credits in 2019 and 2021 for a 9 kw solar array at an average cost of 27000.

Ad Free Online Solar Energy Installation Resource. If you install your photovoltaic system in 2020 the federal tax credit is 26 of the cost of your solar panel system. Federal Investment Tax Credit ITC Colorado Utility or City Incentives.

The percentage you can claim depends on when you installed the equipment. Colorado Spring Utilities offers an installation rebate of 010 per watt. Renewable energy resources.

Holy Cross has a per-kilowatt kW rebate for its customers to reduce the cost of going solar. The federal solar investment tax credit will have the biggest impact on the cost you will face to go solar in Colorado. Installing renewable energy equipment in your home can qualify you for a credit of up to 30 of your total cost.

Colorado State Sales Tax Exemption for Solar Power Systems.

Infographic Cool Facts About How Solar Energy Works Sunpower Solar Blog How Solar Energy Works Solar Energy Solar Energy Diy

This Is It Your Last Day To Get The Huge 26 Tax Credit Visit Trismartsolar Com Right Now And Access The Solar Ca Solar Companies Solar Calculator Solar Logo

Only 5 Days Left Call Now To Get The 26 Solar Tax Credit Before It Tiers Down 888 485 5551 Sunshine Powerofthesun Solar Companies Solar Solar Logo

The Best And Worst States To Get Solar Panels For Your Rooftop Solar Energy Facts Solar Power Solar Power House

What Is Net Metering And How Does It Work Solar Solar Energy System Metering

Home Energy Program Solar Power House Solar Solar Heater Diy

Amazon Com 1 5kw Pluggedsolar With 1500watt Crystalline Solar Panels And Micro Grid Tie Inverter Plug Into Solar Energy Panels Best Solar Panels Solar Panels

Independent Power Systems Installed A 14 49 Kw Commercial Solar Power System On The Roof Of Alpine Botanicals In Neder Solar Solar Projects Solar Power System

Renewable Solar Energy Solar Energy Africa Deciding To Go Green By Converting To Solar Technology Is Certainly A Good One Solar Panels Renewable Solar Solar

Renewable Energy Explained Solar Energy For Home Renewable Energy Renewable Energy Resources

Solar Company Denver Solar Cost Solar Panel Cost Solar Panels For Home

Tri State Announces New 100 Megawatt Solar Project In Southern Colorado Solar Silicon Solar Cell Solar Projects

Diy Solar Solutions Build Yourself A Sunny Future Cleantechies Solar Solutions Solar Power Facts Solar Energy Panels

Solar Company Denver Solar Panel Cost Residential Solar Panels Solar Cost

Ps Solar Systems Solar Energy Tax Credits Solar

Green Energy Solutions Renewablefuel Solar Energy Diy Solar Panels Solar Technology

Seia Applauds Energy Settlement In Colorado Solar Panels Solar Power Panels Solar Power Diy

Pin By Krystian Salva On Solar Renewable Energy Energy Personal Property